unemployment tax refund update october 2021

Ad File your unemployment tax return free. CREG reported an estimated 15 sales and use tax increase statewide from 2020-2021.

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

October 27 2021.

. The 10200 exemption applied to individual taxpayers who earned less than 150000 in modified adjusted gross income. In order to provide unemployment insurance to individuals who qualify for benefits the Wyoming Department of Workforce Services is responsible for collecting unemployment tax from employers. As a result of the relief bill these.

By Anuradha Garg. The agency had sent more than 117 million refunds worth 144 billion as of Nov. Fast Company - June 13 2022 - By Nate Berg 3 years ago Notre-Dame caught on fire.

If you have already registered in WYUI please use the User ID and Password box below to access your account. Are you still waiting for the IRS to return the taxes you paid on your 2020 unemployment benefits. This batch totaled 510 million with the average refund being 1189.

This will be reevaluated again in March when the City Treasurer. This video game lets you fight to save it. They are still issuing those refunds.

The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in. October 12 2021. From 2021 the FUTA tax rate is 60 and it applies to the first 7000 in annual wages paid per employee.

Since then the IRS has. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer. ALL USERS MUST REGISTER IN THE NEW SYSTEM AT ONE OF THE LINKS BELOW.

Welcome to WYUI our new Unemployment Insurance system. The tax agency says it recently sent refunds to another 430000 people who overpaid taxes on their 2020 unemployment benefits. Another 15 million taxpayers are now slated to get refunds averaging over 1600 as part of the IRS adjustment process in the wake of recent legislation.

The IRS just confirmed yes. The IRS efforts to correct unemployment compensation overpayments will help most of the affected. Thats the same data.

WASHINGTON The Internal Revenue Service recently sent approximately 430000 refunds totaling more than 510 million to taxpayers who paid taxes on unemployment compensation excluded from income for tax year 2020. The IRS recently announced that it will start to automatically correct tax returns for those that filed for unemployment in 2020 and also qualify for the 10200 tax break Forbes reported. With The Latest Batch Uncle Sam Has Now Sent Tax Refunds To Over 11 Million Americans For The 10200 Unemployment Compensation Tax Exemption If you received unemployment benefits last year and filed your 2020 tax return relatively early you may find a check in your mailbox soon.

They will go out as the IRS continues to process 2020 tax returns and recalculate returns that were already processed earlier in. IR-2021-212 November 1 2021. IRS sends out 4 million refunds for 2020 unemployment benefit overpayments.

IR-2021-159 July 28 2021. TAS Tax Tip. The agency had sent more than 117 million refunds worth 144 billion as of Nov.

These kinds of unemployment benefits are fully taxed by the IRS and are reported on your federal tax return. The IRS reported that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust taxable income amounts based on the exclusion for unemployment compensation from previously filed income tax returns. The 10200 exemption applied to individual taxpayers who earned less than 150000 in modified adjusted gross income.

The update says that to date the IRS has issued more than 117 million of these special refunds totaling 144 billion. Then the rules changed. COVID-19 RESOURCES FOR CLAIMANTS AND EMPLOYERS.

If you were unemployed during the Covid-19 pandemic then you may be eligible for a future. From 2021 the FUTA tax rate is 60 and it applies to the first 7000 in annual wages paid per employee. When Will Pa Get The Extra 300 Unemployment.

More 2021 unemployment compensation exclusion adjustments and refunds in some cases coming. Your tax rate FUTA varies between 00 and 54 due to various factors including your federal tax responsibility. In compari-son from 2019 to 2020 CREG estimated a 5 increase.

The Departments Unemployment Insurance Division processes employer registrations and quarterly reporting. It all started with passage of the American Rescue Plan Act of 2021 also called ARP that excluded up to 10200 in 2020 unemployment compensation from taxable income. WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust unemployment compensation from previously filed income tax returns.

I filed my taxes on January 28th and included 5 weeks of unemployment income from April 2020 as required at the time. A quick update on irs unemployment tax refunds today. The IRS plans to send another tranche by the end of the year.

The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify for the unemployment. If so I have a quick update.

The american rescue plan act which was signed on march 11 included a 10200 tax exemption for 2020 unemployment benefits. 22 2022 Published 742 am. In the latest batch of refunds announced in November however the average was 1189.

Thousands of taxpayers may still be waiting for a. This is your tax refund unemployment October 2021 update. Millions of people who overpaid taxes on their 2020 unemployment benefits will start getting that money back beginning.

The Wyoming Department of. Therefore the City should be very cautious when considering increasing sales and use tax collection revenue in the FY 2021 budget. The rate of the following years is quite different and lean on many elements.

I waited all summer and finally got my refund of 323 on 1027. Do You Have To File Taxes If You Collect Unemployment.

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

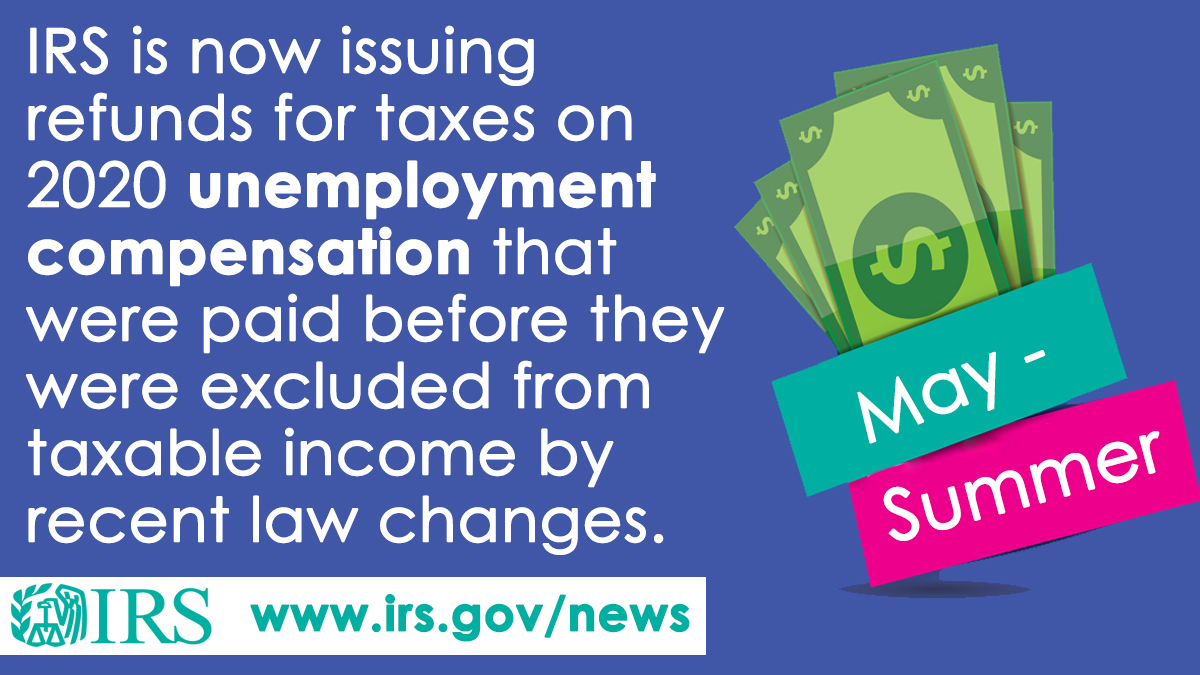

Irsnews On Twitter Irs Is Issuing Refunds For Taxes On 2020 Unemployment Compensation That Were Paid Before They Were Excluded From Taxable Income By Recent Law Changes Details At Https T Co Hcqbfq5oze Https T Co Xgvjz1gws7

Unemployment Tax Refund Question R Irs

Unemployment Tax Refund Update What Is Irs Treas 310 11alive Com

Unemployment Tax Break Refund How To Check Your Irs Transcript For Clues

Unemployment Tax Refund Question I Never Received A Refund And I Believe I Should Ve Can Anyone Help Explain My Transcript To Me I Have Not Filed Another Amended Return Since March

Tax Refund Delays Could Continue As Backlog Of Tax Returns Is Growing Tax Advocate Says Cbs News

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Irs Unemployment Tax Refunds 4 Million More Going Out This Week Abc10 Com

Refund Of State Unemployment Tax

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post

Unemployment Taxes Will You Owe The Irs Credit Com

Still Waiting For Your 10 200 Unemployment Tax Refund How To Check Status Dailynationtoday

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

Anyone Have A June 14 2021 Update Does Anyone Know And Estimate Of How Much I Will Get Back From Unemployment Tax Refund R Irs

What To Keep In Mind About Your Unemployment Tax Refunds Wztv