internet tax freedom act 1998

The Act reflects a. On July 1 2020 the Permanent Internet Tax Freedom Act PITFA will be fully implemented nationwide causing the last few grandfathered states allowed to tax internet service providers to lose an estimated 1.

States Should Be Allowed To Levy Sales Taxes On Internet Access Come Junk With Us

Jun 17 1998.

. ITFA was passed by the House and Senate and President Clinton signed it into law on October 21 1998. Came in 1998 with the passage of the Internet Tax Freedom Act which prohibited US. The Internet Tax Freedom Act ITFA Title XI of the Omnibus Appropriations Act of 1998 was approved as HR.

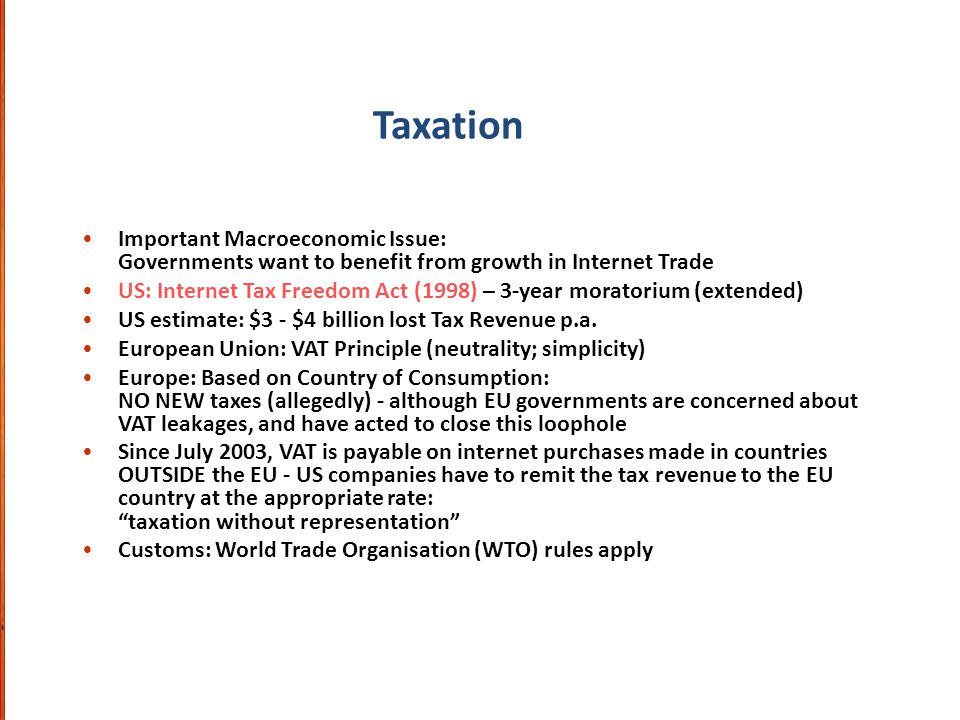

ITFA prohibits Internet access taxes multiple taxation of a single transaction by more than on taxing jurisdiction and discriminatory taxes that do not apply to offline. The Internet Tax Freedom Act ITFA. 105-277 imposed on state and local governments a three-year moratorium from October 1 1998 to October 1 2001 on 1 new taxes on Internet access and 2 multiple or discriminatory taxes on electronic commerce.

Internet Tax Freedom Act - Title I. The Act had a grandfather clause allowing states that already taxed Internet access to continue enforcing those taxes. Of the Internet Tax Freedom Act which was signed into law by President Clinton on October 21 1998.

Mandates statement for the bill as ordered reported by the House Committee on the Judiciary on June 17 1998. MORATORIUM ON CERTAIN TAXES. Advisory commission on electronic commerce.

According to Senate Report 105-184 Congress exercised. The ITFA placed a three-year moratorium on the ability of state and local governments to 1 impose new taxes on Internet access or 2 impose any multiple or discriminatory taxes on electronic commerce. Moratorium preventing state and local governments from taxing Internet access or imposing.

22 hours agoThe first major internet tax policy move in the US. Moratorium on Certain Taxes - Prohibits a State or political subdivision thereof from imposing the following taxes on Internet transactions occurring during the period beginning on October 1 1998 and ending three years after the date of enactment of this Act. 105-277 enacted in 1998 implemented a three-year moratorium preventing state and local governments from taxing Internet access or.

The Internet Tax Freedom Act of 1998 ITFA. The Internet Tax Freedom Act of 1998 did not forbid the taxing of e-commerce but rather forbade the imposition of new and discriminatory taxes. As passed the law banned federal state and local taxes on internet access as well as the creation of internet-only taxes within the US.

Multiple or discriminatory taxes on electronic commerce. The Internet Tax Freedom Act ITFA passed in 1998 imposed a moratorium preventing state and local governments from taxing internet access. The Internet Tax Freedom Act of 1998 temporarily stopped states and local governments from imposing new taxes on Internet access and multiple or discriminatory taxes on electronic commerce.

1 Internet access taxes imposed under specified State. A AMENDMENT- Title 4 of the United States Code is amended by adding at the end the following. 1 taxes on Internet access unless such tax was generally imposed and.

MORATORIUM ON CERTAIN TAXES. Internet Tax Freedom Act. The Act placed a three-year moratorium on any new taxes on Internet access fees and prohibited multiple and discriminatory taxes on electronic commerce.

Available in PDF EPUB and Kindle. This Act may be cited as the Internet Tax Freedom Act of 1998. The act grandfathered the state and local access taxes that were generally imposed and actually.

October 9 1998 Web posted at 1125 AM EDT. State and local governments from imposing taxes on things. Internet Tax Freedom Act of 1998 Title XI of the Omnibus Appropriations Act of 1998 Pub.

The Internet Tax Freedom Act of 1998 ITFA was enacted on October 21 1998. Committee on the Judiciary and published by Unknown online. To establish a national policy against State and local interference with interstate commerce on the Internet or online services and to excise congressional jurisdiction over interstate commerce by establishing a moratorium on the imposition of exactions that would interfere with the free flow of commerce via the Internet.

The ACEC is the federal commission created by the Internet Tax Freedom Act of. Passed by House of Representatives June 23 1998. Cost Estimate Mandates statement for the bill as ordered reported by the House Committee on the Judiciary on June 17 1998.

This book was released on 11 April 1998 with total page 29 pages. Senate passes Internet Tax Freedom Act. CHAPTER 6--MORATORIUM ON CERTAIN TAXES Sec.

The Internet Tax Freedom Act of 1998 temporarily stopped states and local governments from imposing new taxes on Internet access and multiple or discriminatory taxes on electronic commerce. Internet Tax Freedom Act of 1998 - Prohibits for three years after enactment of this Act any State or political subdivision from imposing assessing collecting or attempting to collect taxes on Internet access bit taxes or multiple or discriminatory taxes on electronic commerce with exceptions for. As of July 1 2020 those fees will be.

3529 Internet Tax Freedom Act of 1998. The 1998 Internet Tax Freedom Act was a United States law authored by Representative Christopher Cox and Senator Ron Wyden and signed into law on October 21 1998 by President Bill Clinton in an effort to promote and preserve the commercial educational and informational potential of the Internet. As first enacted on October 21 1998 the ITFA imposed a three-year moratorium on the ability of state and local governments to impose taxes on internet access and certain internet transactions to the extent permitted by the Constitution and any other federal law in effect on that date.

Internet is not tax-free. Download or read book entitled Internet Tax Freedom Act of 1998 written by United States. Senate voted Thursday 96 to 2 to approve a bill that places a prohibition on.

4328 by Congress on October 20 1998 and signed as Public Law 105-277 on October 21 1998. The Internet Tax Freedom Act ITFA passed in 1998 imposed a moratorium preventing state and local governments from taxing internet access. By Nancy Weil IDG -- The US.

105-277 enacted in 1998 implemented a three-year. To establish a national policy against State and local interference with interstate commerce on the Internet to exercise congressional jurisdiction over interstate commerce by establishing a moratorium on the imposition of exactions that would.

What Is The Internet Tax Freedom Act Howstuffworks

Ethical Legal And Public Policy Issues In E Business Ppt Download

Michael Mazerov Center On Budget And Policy Priorities

What Is The Internet Tax Freedom Act Howstuffworks

Didn T The Internet Tax Freedom Act Itfa Ban Taxes On Sales Over The Internet Sales Tax Institute

Controversial Internet Tax Freedom Act Becomes Permanent July 1

What Is The Internet Tax Freedom Act Howstuffworks

Internet An Overview Of Key Technology Policy Issues Affecting Its Use And Growth Everycrsreport Com

Telecom Industry Ties Internet Tax Ban To Net Neutrality The Hill

Didn T The Internet Tax Freedom Act Itfa Ban Taxes On Sales Over The Internet Sales Tax Institute

Didn T The Internet Tax Freedom Act Itfa Ban Taxes On Sales Over The Internet Sales Tax Institute

Permanent Internet Tax Freedom Act The Hill

Taxation Of Internet Sales And Access Legal Issues Everycrsreport Com

What Is The Internet Tax Freedom Act Howstuffworks

Permanent Internet Tax Freedom Act The Hill